Your help is needed to make change happen.

What is the Georgia State FairTax® Initiative?

Georgians for Fair Taxation has launched a major initiative to replace Georgia’s state income tax code with a consumption tax modeled on the FairTax. With one of the highest unemployment rates in the country and our state’s economy still struggling to recover from the economic downturn in 2008, Georgia needs an economic boost. A state consumption tax to replace the income tax is the answer Georgia needs.

Watch This Short Video to Learn More About How the FairTax Will Benefit Georgia

Want more?

This article breaks down the case for a FairTax in Georgia. Phil Hinson makes the case for why the State FairTax would be beneficial for Georgians, and how it can ultimately lead to passage of the national FairTax bill.

Soon we will be publishing a copy of the Georgia State Fairtax Initiative had prepared for us by the attorney who wrote the national FairTax bill that is in Congress.

This is the official Beacon Hill Institute Study report, which analyzed the financial side of the Georgia FairTax Bill and determined the sales tax rate necessary for the state FairTax.

WTOC in Savannah interviews GFFT board member Mike Warlick about the FairTax bill for Georgia.

This is the Resolution in Support of a State FairTax for Georgia that districts are using to show support for the FairTax: Resolution on State FairTax 2016

Some people have voiced some objections to the state FairTax. In this article, we address each of these objections and explain why the concerns are unfounded: Objection Counters on State FairTax Bill

Here are additional PDF Resources you may find helpful:

States without income taxes fare better economically than states burdened with income taxes. Many people are voting with their feet, moving from high-tax states to no-tax states. Even New York State has recognized that taxes affect business development by offering businesses that move there an exemption from all business taxes, including income tax, for 10 years.

Georgia’s neighbors Florida and Tennessee don’t have an income tax and they’re doing better economically than Georgia.

It’s time to change that, and that’s why Georgians for Fair Taxation is working to have legislation prepared that will replace our state income tax with a FairTax- modeled consumption tax. The state bill must include these essential features:

- Elimination of all income-based taxes, both personal and corporate, and thus the myriad exemptions, exceptions, and exclusions

- Expansion of the tax base to include new goods (not used) and services

- A monthly “pre-bate” to offset the state FairTax paid on necessities up to the poverty level.

By passing a state FairTax bill, Georgia can set an example for other states to follow. When states prove the viability of replacing income tax with the FairTax, a national FairTax bill moves much closer to reality.

Our task is a challenge, and GFFT needs your help.

- To volunteer your time to help in this effort, please click here.

- To help financially with this costly endeavor, please click here to make your donation. Any funds you contribute to the State FairTax Initiative will be used exclusively for that purpose.

Want to support this legislation for Georgia?

We need your support to write a bill that can make a statement to the country and make our state a FairTax State!

News About the State FairTax Initiative

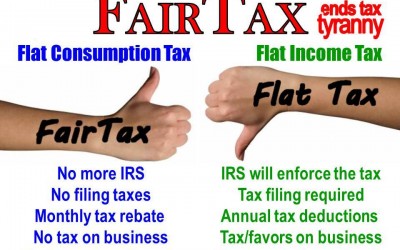

The Georgia FairTax®: Accept No Substitutes!

Philip L. Hinson, CPA Georgians for Fair Taxation (GFFT) has been hard at work on a state tax reform proposal modeled after the national FairTax proposal, which enjoys widespread support in Georgia. Although the model would work somewhat differently at the state level...

You Can’t Have Your Cake and Eat It Too!

As the 2016 presidential campaign gathers momentum, candidates are offering several flavors of tax reform; several of them are promising to eliminate the IRS; and all of them are saying their plan is the best. Only one candidate wholeheartedly supports the...